All Categories

Featured

Table of Contents

This provides the plan owner returns alternatives. Reward alternatives in the context of life insurance policy describe just how insurance holders can pick to use the rewards generated by their whole life insurance plans. Dividends are not guaranteed, however, Canada Life for instance, which is the oldest life insurance policy company in Canada, has actually not missed a dividend settlement given that they initially developed a whole life plan in the 1830's before Canada was even a nation! Right here are the common dividend choices offered:: With this option, the insurance policy holder makes use of the dividends to buy extra paid-up life insurance policy protection.

This is only suggested in the instance where the fatality benefit is very essential to the plan proprietor. The added cost of insurance policy for the enhanced coverage will lower the cash money value, therefore not ideal under infinite financial where money worth determines just how much one can obtain. It's vital to keep in mind that the schedule of dividend alternatives may differ relying on the insurer and the certain plan.

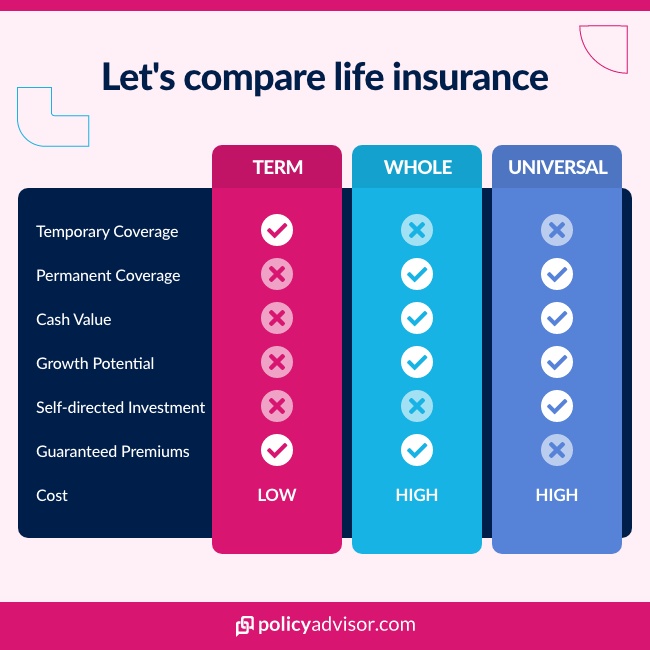

Although there are excellent benefits for unlimited financial, there are some things that you need to consider prior to getting involved in boundless banking. There are likewise some disadvantages to limitless banking and it could not appropriate for a person that is looking for cost effective term life insurance, or if a person is looking right into acquiring life insurance policy exclusively to secure their household in case of their death.

It's essential to comprehend both the benefits and constraints of this financial technique before deciding if it's right for you. Complexity: Infinite banking can be complicated, and it is essential to recognize the information of how an entire life insurance policy policy works and just how plan financings are structured. It is very important to appropriately set-up the life insurance coverage policy to enhance boundless banking to its complete capacity.

Can Infinite Banking Wealth Strategy protect me in an economic downturn?

This can be particularly problematic for individuals who count on the death benefit to offer their loved ones (Private banking strategies). Overall, unlimited financial can be a valuable monetary approach for those that recognize the information of just how it functions and want to approve the costs and restrictions related to this investment

Pick the "wide range" option as opposed to the "estate" option. Most firms have 2 different sorts of Whole Life strategies. Choose the one with greater cash money values previously on. Over the course of a number of years, you add a significant quantity of cash to the policy to construct up the cash worth.

You're essentially lending money to yourself, and you repay the loan with time, often with rate of interest. As you repay the finance, the cash worth of the policy is renewed, enabling you to obtain against it once more in the future. Upon fatality, the survivor benefit is minimized by any kind of exceptional loans, however any kind of remaining survivor benefit is paid tax-free to the recipients.

Self-banking System

Time Perspective Threat: If the policyholder decides to terminate the policy early, the cash money surrender values may be considerably less than later years of the policy. It is suggested that when exploring this strategy that has a mid to long-term time horizon. Tax: The policyholder might sustain tax repercussions on the car loans, dividends, and fatality advantage repayments obtained from the plan.

Complexity: Infinite banking can be complicated, and it is very important to comprehend the details of the plan and the money buildup component before making any investment decisions. Infinite Financial in Canada is a reputable financial method, not a fraud. Infinite Financial is an idea that was created by Nelson Nash in the USA, and it has actually considering that been adjusted and carried out by economic professionals in Canada and other countries.

Plan loans or withdrawals that do not exceed the modified price basis of the plan are considered to be tax-free. If policy financings or withdrawals exceed the adjusted expense basis, the excess amount may be subject to taxes. It is very important to note that the tax benefits of Infinite Financial may go through change based on changes to tax obligation laws and policies in Canada.

The dangers of Infinite Financial include the potential for plan fundings to reduce the survivor benefit of the plan and the opportunity that the plan may not do as anticipated. Infinite Banking might not be the very best method for everybody. It is very important to thoroughly think about the costs and potential returns of taking part in an Infinite Financial program, as well as to thoroughly research study and comprehend the associated dangers.

How can Infinite Banking Benefits reduce my reliance on banks?

Infinite Financial is various from typical financial because it allows the insurance policy holder to be their own source of funding, as opposed to counting on standard financial institutions or lending institutions. The insurance holder can access the money worth of the plan and utilize it to finance purchases or investments, without having to go with a conventional lending institution.

When the majority of people require a loan, they get a credit line through a conventional financial institution and pay that car loan back, over time, with rate of interest. What if you could take a financing from yourself? Suppose you could prevent the big banks entirely, be your very own bank, and supply yourself with your very own line of credit report? For physicians and other high-income income earners, this is feasible to do with boundless financial.

Below's a monetary expert's evaluation of infinite banking and all the advantages and disadvantages entailed. Limitless banking is a personal banking technique established by R. Nelson Nash. In his book Becoming Your Own Banker, Nash discusses how you can utilize an irreversible life insurance policy plan that constructs cash worth and pays rewards therefore releasing on your own from having to borrow cash from loan providers and pay back high-interest finances.

What is the minimum commitment for Tax-free Income With Infinite Banking?

And while not every person gets on board with the idea, it has actually challenged hundreds of thousands of people to reassess exactly how they bank and how they take finances. Between 2000 and 2008, Nash released 6 versions of guide. To now, monetary consultants contemplate, practice, and question the idea of boundless banking.

The basis of the infinite banking concept starts with permanent life insurance coverage. Infinite banking is not possible with a term life insurance coverage policy; you should have a long-term cash money value life insurance plan.

With a dividend-paying life insurance coverage policy, you can expand your cash money worth also quicker. One point that makes entire life insurance distinct is gaining even more money through rewards. Expect you have an irreversible life insurance plan with a mutual insurer. Because situation, you will certainly be qualified to get part of the business's earnings much like just how shareholders in the company obtain dividends.

Latest Posts

Infinite Banking Institute

How To Be Your Own Bank With Whole Life Insurance

Ibc Savings Account Interest Rate