All Categories

Featured

Table of Contents

You then purchase the car with cash. You deplete the fund when you pay cash money for the vehicle and renew the sinking fund only to the previous level.

That is exactly how you stay on top of inflation. The sinking fund is always expanding through rate of interest from the saving account or from your vehicle settlements to your car sinking fund. It likewise occurs to be what infinite banking conveniently neglects for the sinking fund and has outstanding recall when related to their life insurance coverage item.

That, we are informed, is the rise in our cash value in year 2. The real boast ought to be that you added $220,000 to the unlimited financial plan and still only have a Cash money Worth of $207,728, a loss of $12,272 up to this point

What resources do I need to succeed with Wealth Management With Infinite Banking?

You still have a loss no matter what column of the estimate you utilize.

Now we transform to the longer term rate of return with limitless financial. Before we disclose real long-term price of return in the whole life plan forecast of a marketer of unlimited banking, allow's ponder the idea of tying a lot money up in what in the video clip is called an interest-bearing account.

The only means to transform this right into a win is to utilize faulty mathematics. However first, review the future value calculator listed below. (You can utilize a selection of other calculators to get the same results.) After 10 years you take care of a bit more than a 2% yearly price of return.

Infinite Banking Retirement Strategy

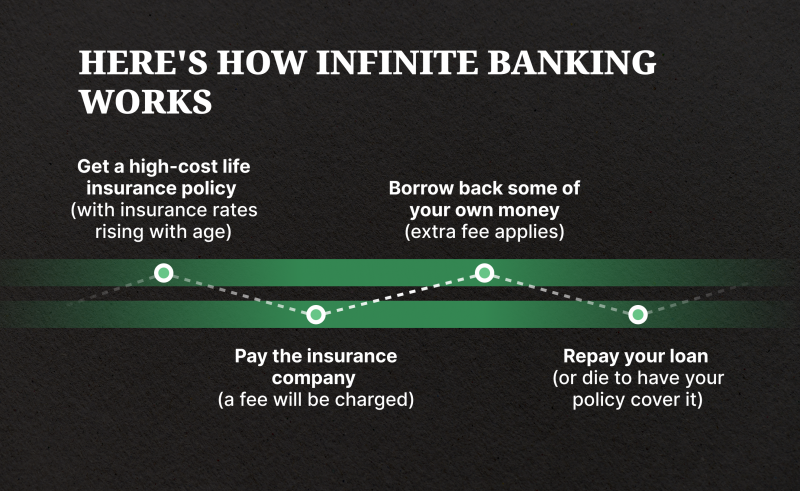

The concept is to obtain you to think you can gain money on the cash borrowed from your unlimited banking account while all at once gathering an earnings on other financial investments with the same cash. When you take a car loan from your entire life insurance plan what really occurred?

The "correctly structured entire life plan" bandied around by sellers of unlimited banking is truly just a life insurance coverage firm that is owned by insurance policy holders and pays a returns. The only reason they pay a reward (the rate of interest your money value earns while obtained out) is due to the fact that they overcharged you for the life insurance policy.

Each insurance coverage company is various so my example is not an excellent suit to all "effectively structured" infinite financial instances. THIS IS AN ADDITIONAL FUNDING OF YOUR BOUNDLESS BANKING ACCOUNT AND NOT REVEALED IN THE IMAGE!

What are the common mistakes people make with Cash Flow Banking?

Even if the insurance provider attributed your cash worth for 100% of the interest you are paying on the lending, you are still not getting a complimentary ride. Policy loans. YOU are spending for the interest credited to your money value for the amounts lent out! Yes, each insurer entire life policy "effectively structured" for limitless financial will vary

When you die, what takes place with your entire life insurance plan? Remember when I pointed out the finance from your cash worth comes from the insurance coverage business basic fund? Well, that is since the money worth belongs to the insurance coverage business.

Life insurance coverage business and insurance policy representatives love the concept and have adequate reason to be blind to the deadly defects. In the end there are just a couple of factors for using long-term life insurance and limitless financial is not one of them, no issue how "appropriately" you structure the policy.

This in no chance suggests you require to enter into financial debt so you can use this approach. The next method is a variant of this method where no financial debt is essential. The only reason that I begin with this strategy is because it can produce a bigger return for some individuals and it likewise aids you "leave financial debt much faster." Here is just how this technique works: You will require a home loan and line of debt.

Is Infinite Banking For Financial Freedom a better option than saving accounts?

Your regular home loan is now paid down a little bit extra than it would have been. Rather than keeping greater than a token quantity in your bank account to pay bills you will drop the cash into the LOC. You now pay no interest because that quantity is no more obtained.

Your rate of return on your everyday float is the price of rate of interest on the home loan. If your LOC has a greater interest price than your mortgage this technique faces troubles. When rate of interest rates were extremely low for a decade this strategy worked far better. If your home mortgage has a higher rate you can still utilize this technique as long as the LOC rate of interest price is similar or less than your mortgage rates of interest.

The anybody can utilize (Self-banking system). Infinite banking, as advertised by insurance agents, is made as a big savings account you can borrow from. Your original cash maintains making even when obtained bent on you while the obtained funds are spent in various other income producing possessions, the so-called double dip. As we saw above, the insurance provider is not the cozy, blurry entity giving out free money.

If you remove the insurance company and invest the same cash you will certainly have extra due to the fact that you don't have middlemen to pay. And the interest rate paid is most likely higher, depending on current rate of interest prices.

What are the risks of using Infinite Banking Concept?

Here is the magic of unlimited banking. When you borrow your own cash you also pay on your own a rate of interest rate.

Latest Posts

Generation Bank: Front Page

Infinite Banking Institute

How To Be Your Own Bank With Whole Life Insurance